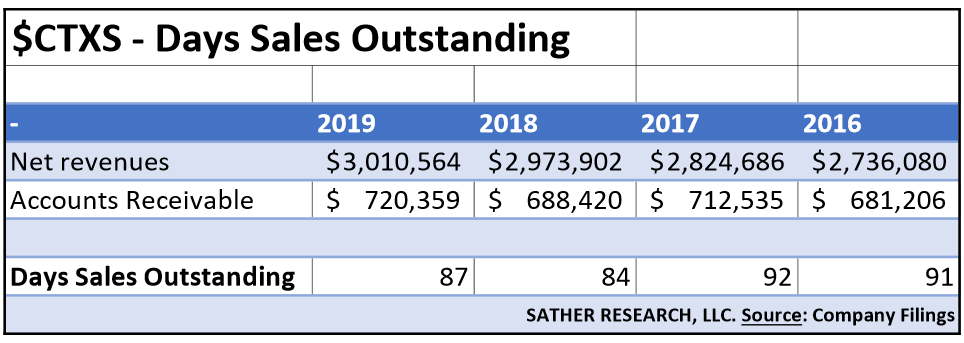

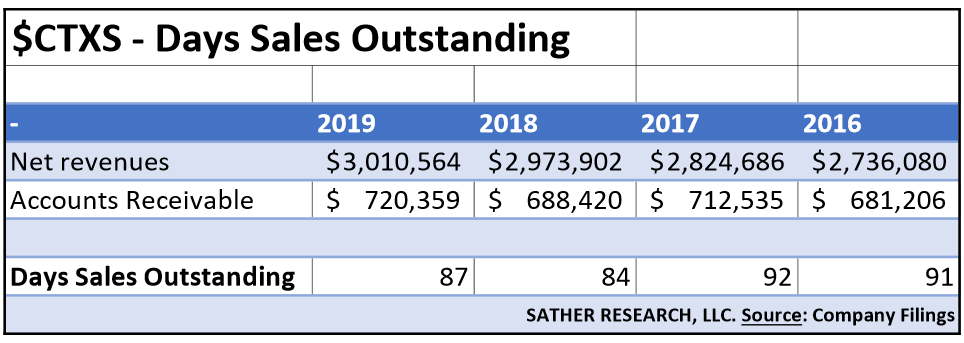

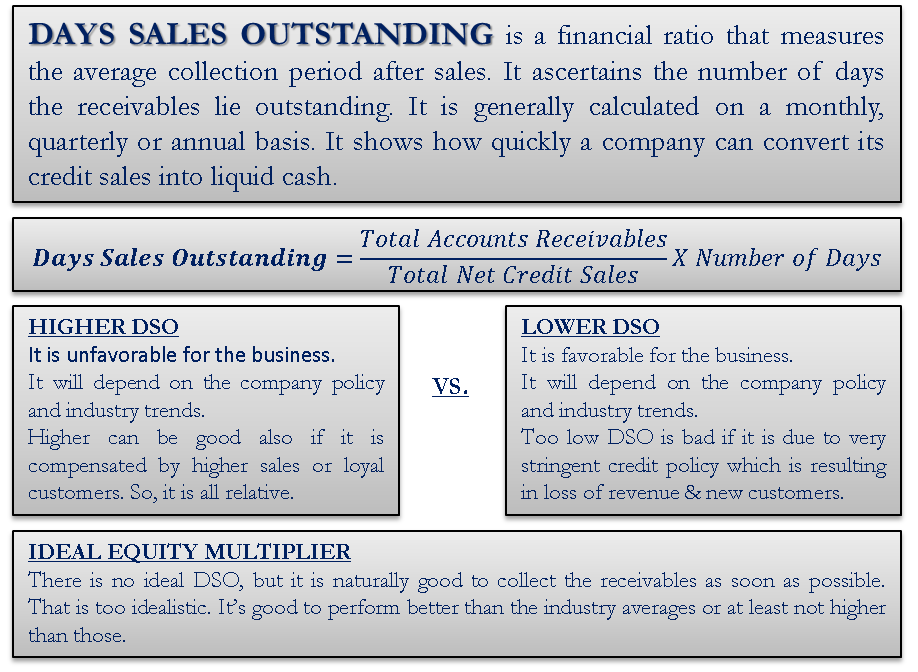

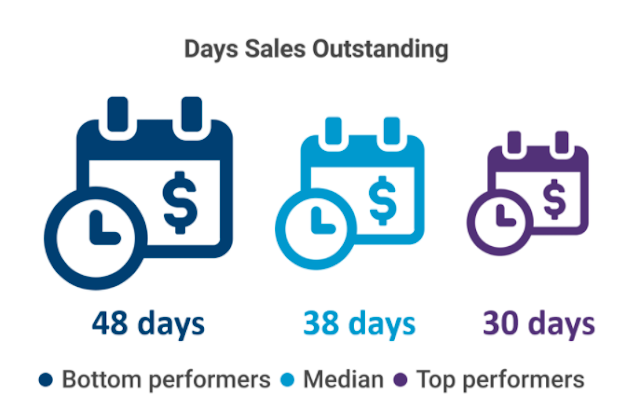

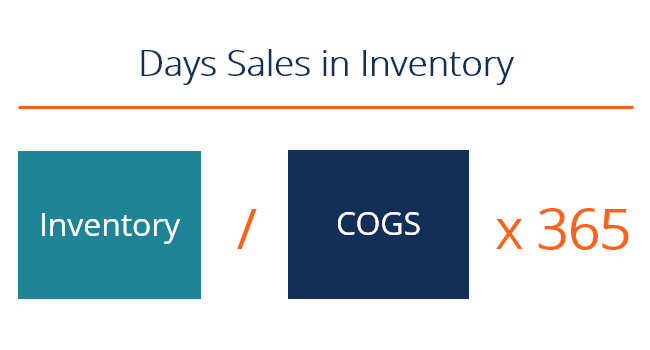

Days Sales in Inventory (DSI), sometimes known as inventory days or days in inventory, is a measurement of the average number of days or time required for a business to convert its inventoryDays Sales Outstanding measures the average number of days that a company takes to collect revenue after a sale has been made It is a financial ratio that illustrates how well a company's Accounts Receivable are being managed Accounts Receivable can be measured by Days Sales Outstanding Target's Days Sales Outstanding for the fiscal yearInterpretation Days Sales Outstanding shows how long it takes for a business to recover the revenue receipts from its trade receivables Using the example above, for instance, we can conclude that during the year ended 30 June X5 it took HIJ PLC an average of 15 days to collect revenue receipts from its trade debtors

Finance Ratio The Dso Calculation With Average Dso For The S P 500

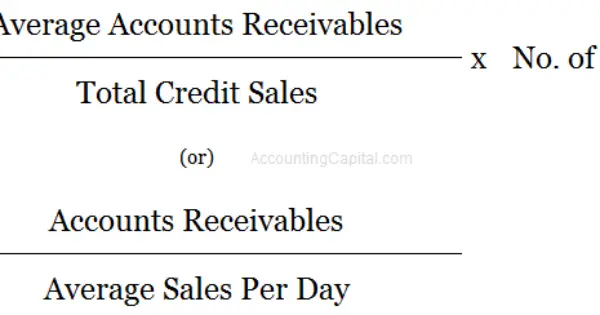

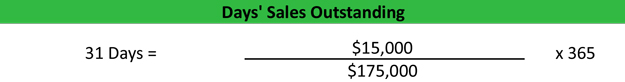

How to calculate the number of days sales in receivables

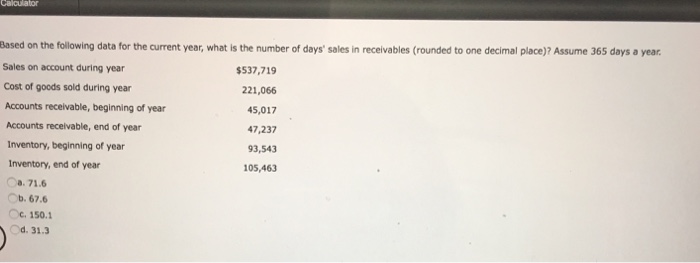

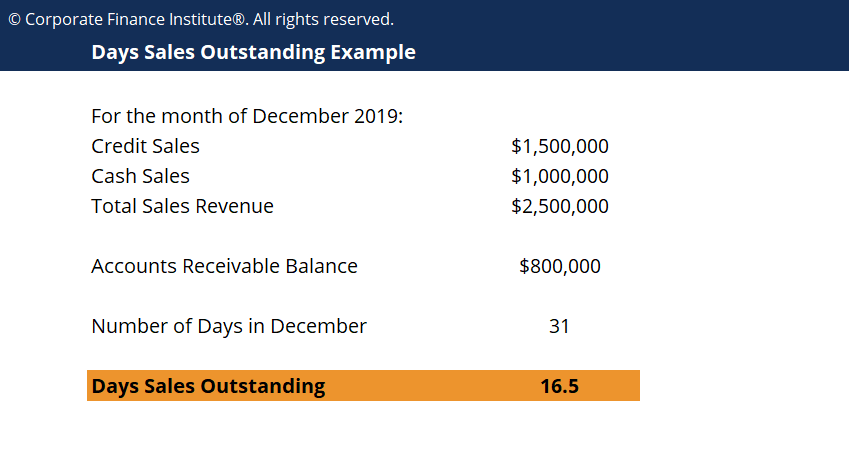

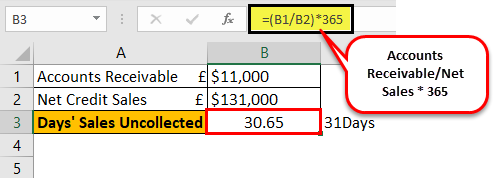

How to calculate the number of days sales in receivables-Accounts Receivable Days is an accounting concept related to Accounts Receivable It is the length of time it takes to clear all Accounts Receivable, or how long it takes to receive the money for goods it sells This is useful for determining how efficient the company is at receiving whatever shortterm payments it is owed The formula for Accounts Receivable Days is (Accounts Receivable DSO= (Total AR/Net Credit Sales)*(Number of days) = (15,000/10,000)*(30) = 45 days Based on the above calculation, the DSO is 45 days, which means that it takes an average of 45 days before the company ABC can collect its receivables Generally, a DSO below 45 days is considered to be a low DSO

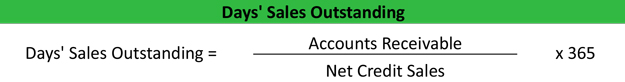

Days Sales Outstanding

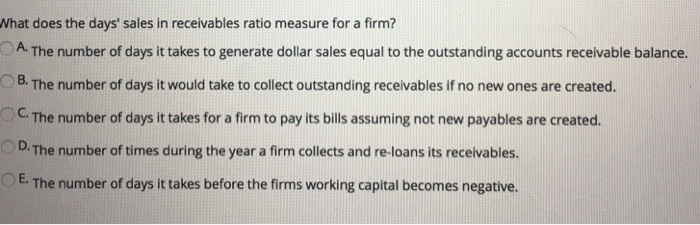

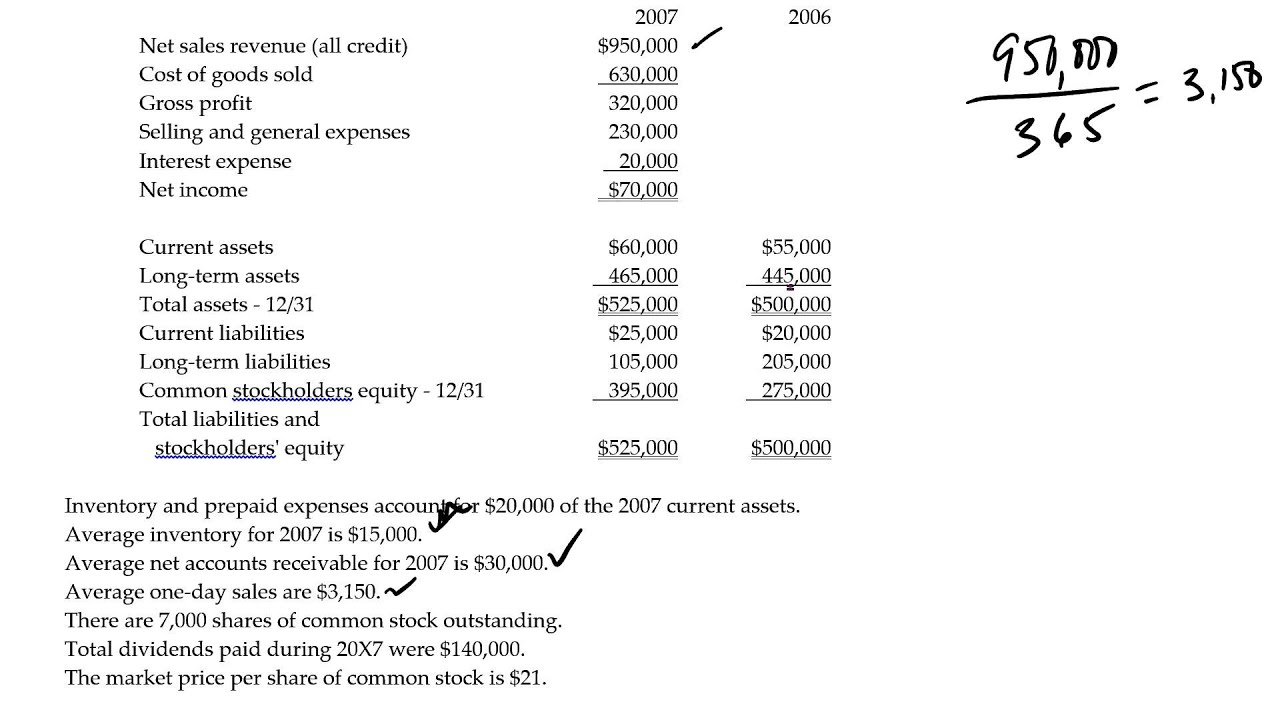

A The number of days it takes to generate dollar sales equal to the outstanding accounts receivable balance B The number of days it would take to collect outstanding receivables if no new ones are created C The number of days it takes for a firm to pay its bills assuming not new payables are created DNet Sales $1,000,000 Plugging these numbers into the DSO calculation, they see DSO = $350,000 / ($1,000,00 / 180) DSO = 63 For 60day terms, meaning their customers can take up to 60 days to pay, a DSO of 63 is not too shabby As we've shown, there are many reasons why some customers may pay late The period for this example begins at 1/1/09 and ends at 12/31/09 The number of days for this period, then, would be 365 Manufactco's accounts receivable equation for the number of days a receivable is outstanding is 365 days / 5 times = 73 days for AR to turnover This means that all open accounts receivable are collected and closed every

Days of Sales Outstanding = Accounts Receivable / (Annual Sales / 365) Example A company has accounts receivable of $3,000 and annual sales of $16,000 Days of Sales Outstanding = $3,000 / ($16,000 / 365) = $3,000 / $436 = 6845 Therefore, this company has 685 days of sales outstanding Sources and more resources Wikipedia – Days sales Here is the days sales outstanding formula (Accounts Receivable/ Total Sales) x Number of Days = DSO For example, if you wanted to calculate the annual DSO for a business with $225M in it's A/R balance sheet and $150M in total sales, the formula would look like this ($22,500,000 / $150,000,000) x 365 = 5475 daysIf the number of receivables is the quarter of the annual revenue, this does not mean that its turnover period is 90 days and all of it is repaid within this period Such an indicator may mean that one counterparty pays for the products within 30 days, and the other within 180 days

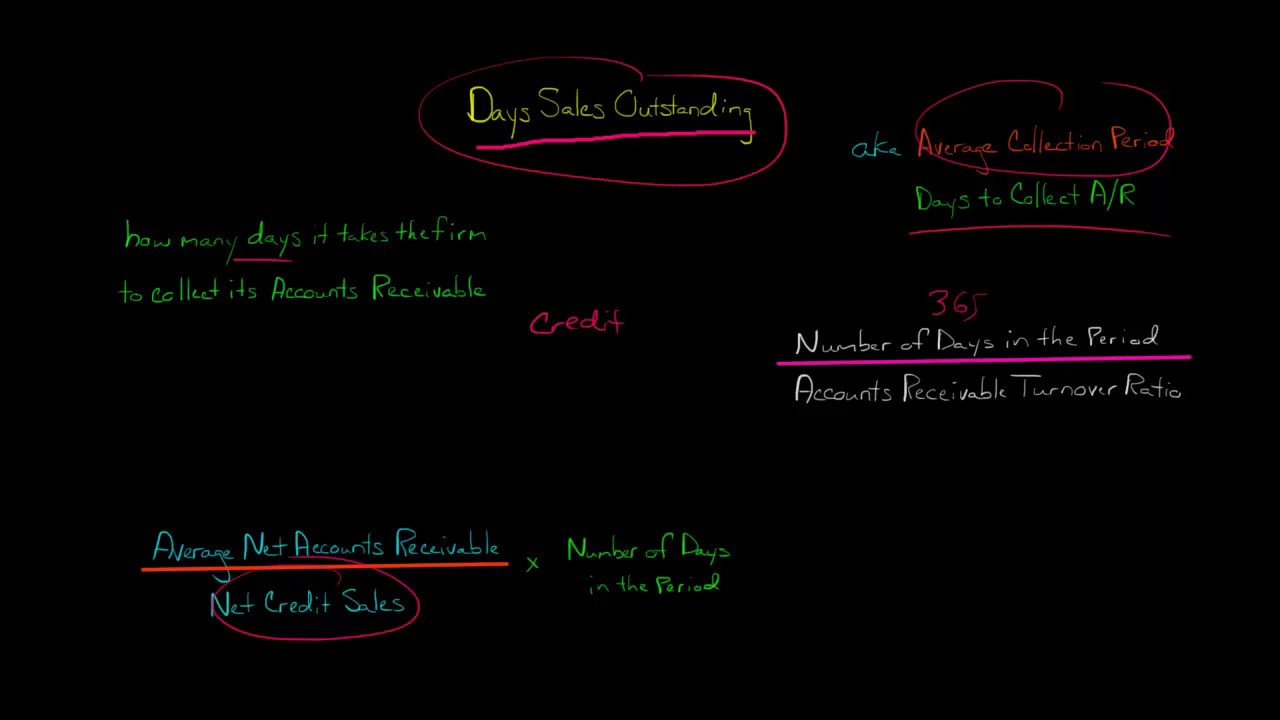

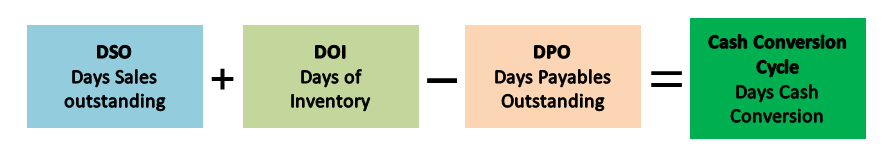

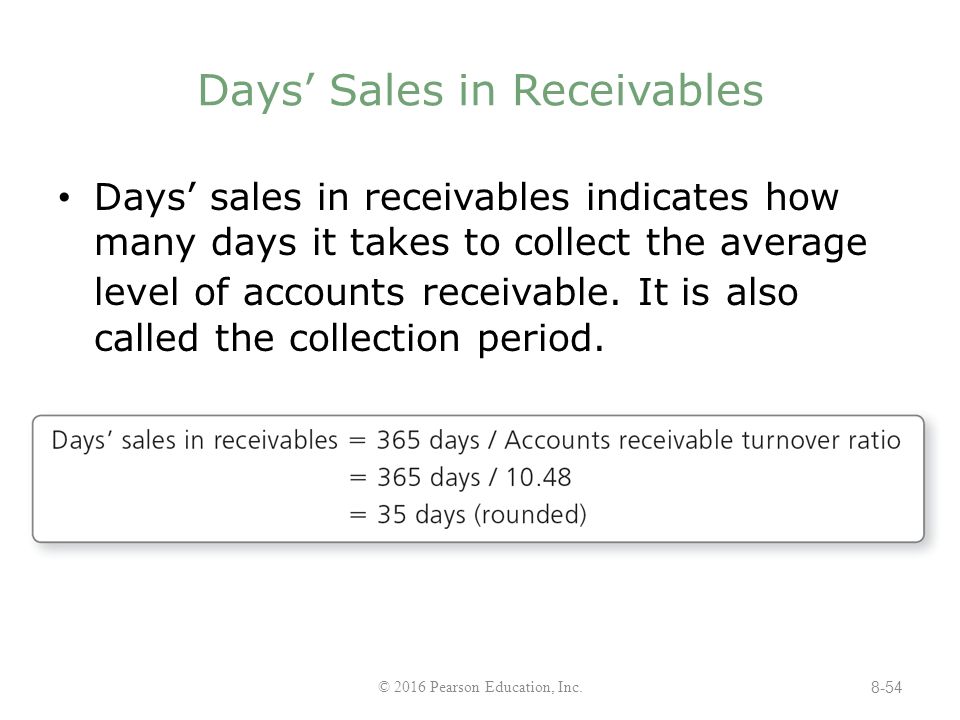

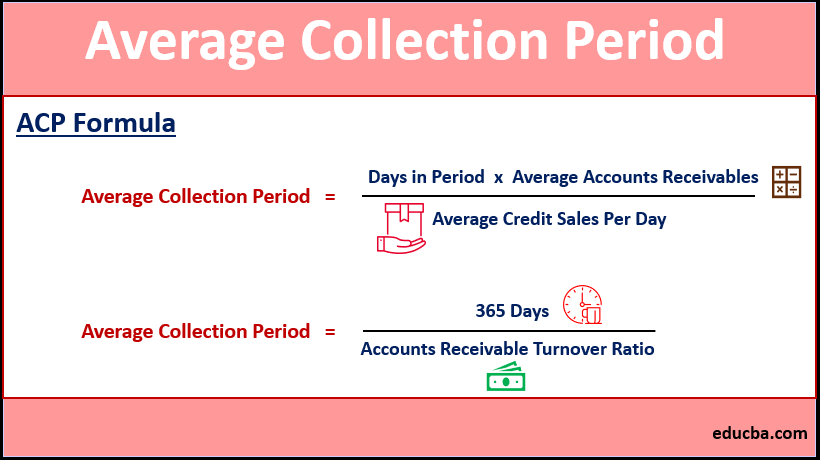

Days sales outstanding is an element of the cash conversion cycle and may also be referred to as days receivables or average collection period 144 Day Sales OutstandingNUMBER OF DAYS SALES IN RECEIVABLES (also called average collection period) The number of days of net sales that are tied up in credit sales (accounts receivable) that haven't been collected yet Permanent accounts The accounts found on the Balance Sheet;Days' Sales In Receivables ExampleHelp us caption & translate this video!http//amaraorg/v/FOvo/

1

Accounts Receivable Turnover Ratio Formula Examples

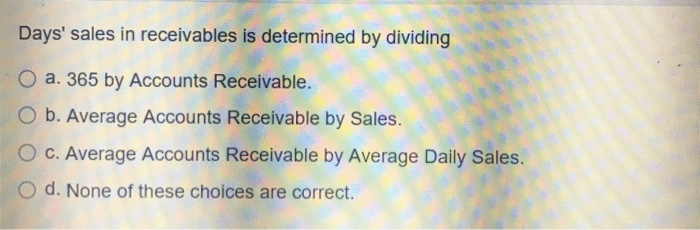

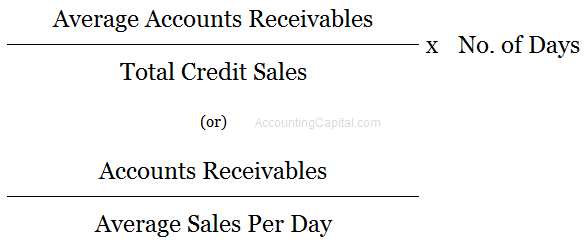

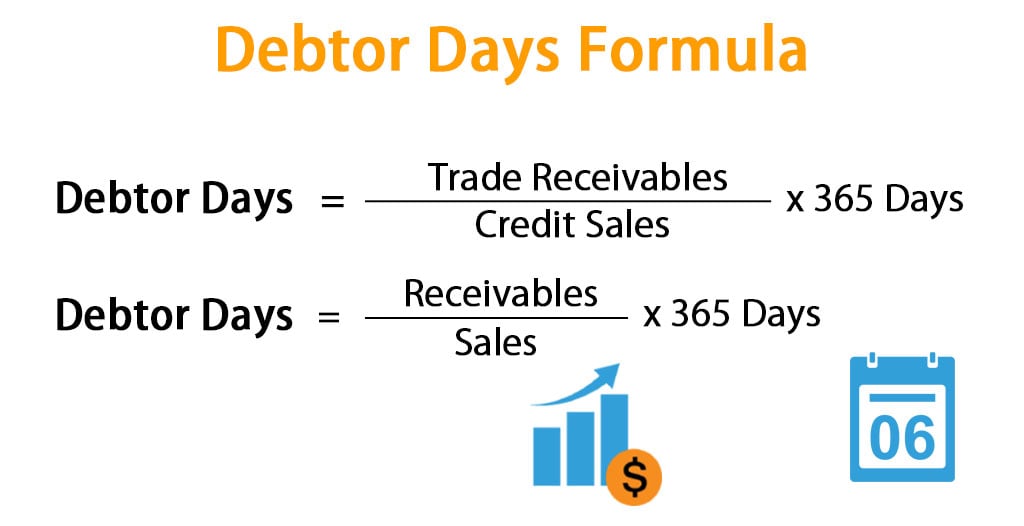

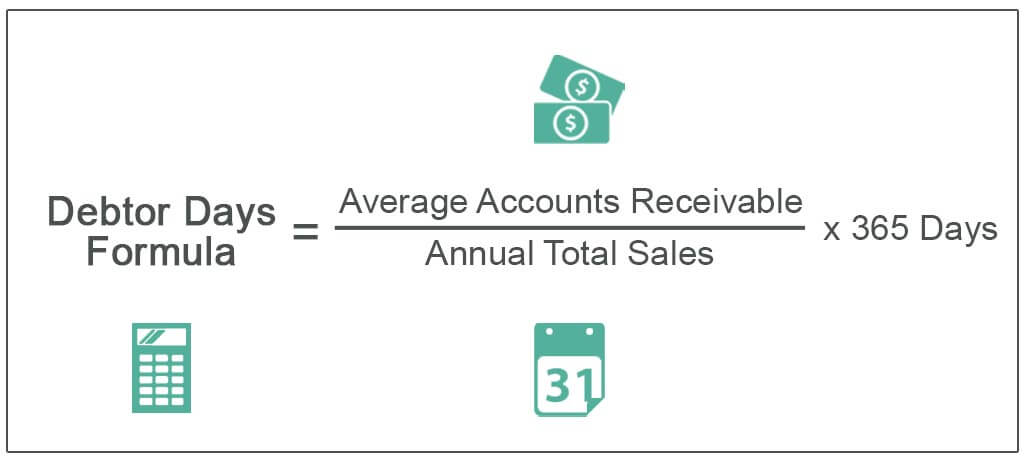

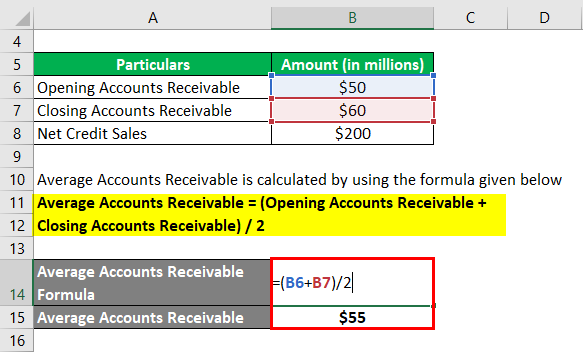

Definition of NUMBER OF DAYS SALES IN RECEIVABLES NUMBER OF DAYS SALES IN RECEIVABLES (also called average collection period) The number of days of net sales that are tied up in credit sales (accounts receivable) that haven�t been collected yet Further, the average daily sales can also be calculated by dividing the annual total sales by 365 days (number of days in a year) Average daily sales = Annual total sales / 365 Finally, the debtor days ratio calculation is done by dividing the average accounts receivable by the total annual sales and then multiply by 365 daysThese account balances are carried forward for the lifetime of the company

Pdf The Role Of Controlling Credit Sales And Receivables In The Wood Processing Companies Of Tuzla Canton Bosnia And Herzegovina

Finance Ratio The Dso Calculation With Average Dso For The S P 500

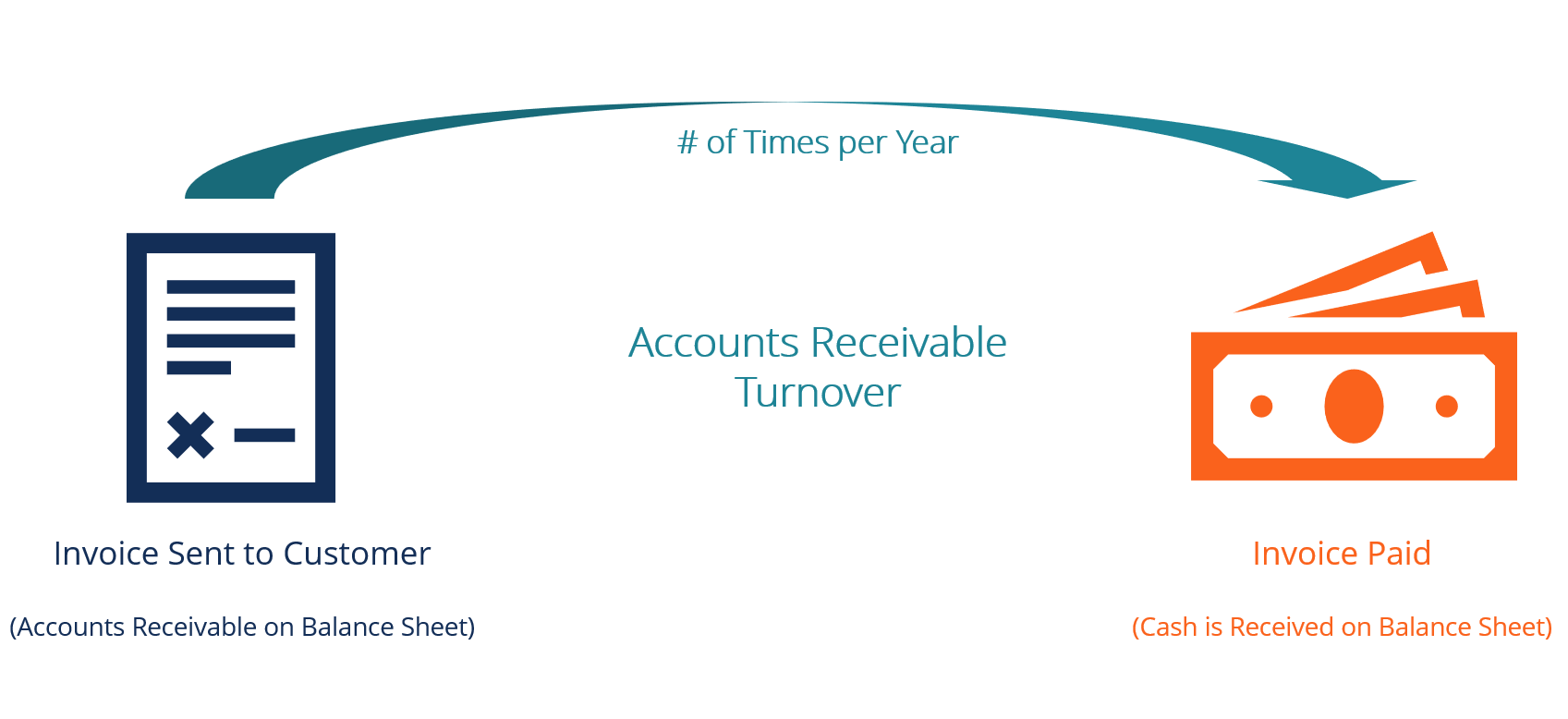

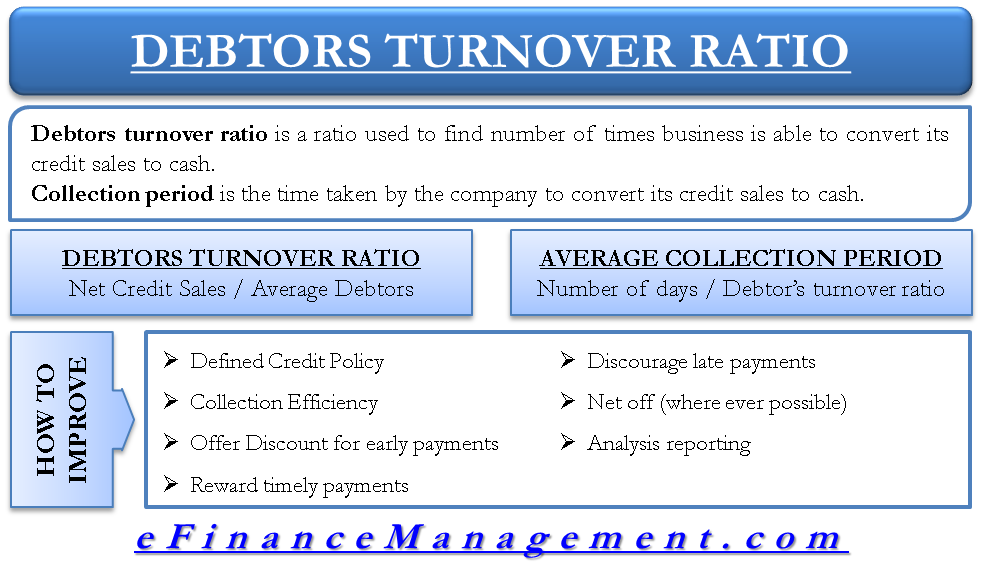

Accounts receivable days is the number of days that a customer invoice is outstanding before it is collected The point of the measurement is to determine the effectiveness of a company's credit and collection efforts in allowing credit to reputable customers, as well as its ability to collect cash from them in a timely manner The measurement is usually applied to theThis indicates that on average the company's accounts receivables turned over 10 times during the year, or approximately every 36 days (360 or 365 days per year divided by the turnover of 10)DSO Formula = Accounts Receivables / Net Credit Sales * 365 Or, Days Sales Outstanding = $90,000 / $450,000 * 365 = 1/5 * 365 = 73 days That means Company Xing takes 73 days to collect money from its debtors on an average Example#2 Company Zang has the following information – Cost of Sales – $300,000

Accounts Receivable Turnover Days

The Number Of Days Sales In Receivables A Chegg Com

The turnover rate will increase if the receivables balance decreases or the sales revenue increases Therefore, when the turnover rate increases, the number of days' sales in accounts receivable Days sales outstanding (DSO) is the ratio of receivables to the daily average of credit sales How Does Days Sales Outstanding (DSO) Work?The denominator (Cost of Sales / Number of Days) represents the average per day cost being spent by the company for manufacturing a salable product The net factor gives the average number of days

Ai In Accounts Receivables Payment Forecasting By Samantha Wong Linkedin

Days Sales Outstanding Dso Ratio Formula Calculation

Days sales in receivables ending inventory cost of goods sold / 365 inventory turnover cost of goods sold average inventory inventory turnover in days average inventory COGS /365 operating cycle a/r turnover in days inventory turnover in days working capital current assets current liabilities current ratioAccounts Receivable Days = (Accounts Receivable / Revenue) x 365 Let's look at an example to see how this works in practice Imagine Company A has a total of $1,000 in their accounts receivable, along with an annual revenue of $800,000 Then, you can use the accounts receivable days formula to work out your total as follows When using this average collection period ratio formula, the number of days can be a year (365) or a nominal accounting year (360) or any other period, so long as the other data—average accounts receivable and net credit sales—span the same number of days

Receivables Chapter 8 Chapter 8 Explains Receivables Ppt Download

Days Sales Outstanding Double Entry Bookkeeping

His accounts receivable turnover ratio is 10, which means that the average accounts receivable are collected in 365 days That bodes well for his cash flow and his personal goals Days Sales Outstanding (DSO) represents the average number of days it takes credit sales to be converted into cash or how long it takes a company to collect its account receivables Accounts Receivable Accounts Receivable (AR) represents the credit sales of a business, which have not yet been collected from its customers The numerator is 365, the number of days in the year Because the accounts receivable turnover ratio determines an average accounts receivable figure, the outcome for the days' sales in receivables is also an average number Using this formula, compute BWW's number of days' sales in receivables ratio for 17 and 18

What Is Days Sales Outstanding Dso Accountingcapital

Based On The Following Data For The Current Year Chegg Com

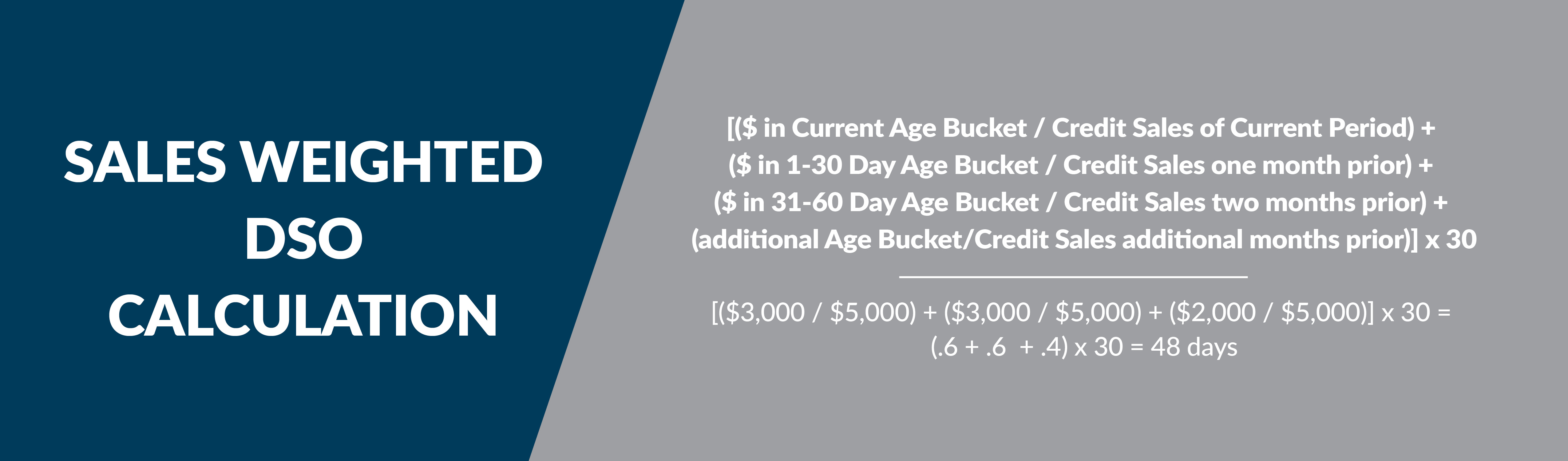

(Total Receivables / Total Credit Sales) × Number of Days = Regular DSO Here is an example scenario Total Receivables = 4,600,000 JPY Total Credit Sales = 9,000,000 JPY Number of days in period = 90 Here is the calculation In this example, it takes 45 days (on the average) to collect the receivables Days sales outstanding is closely related to accounts receivable turnover, as DSO can also be expressed as the number of days in a period divided by the accounts receivable turnover The lower the DSO , the shorter the time it takes for a company to collect Receivable days represent the number of days customers are taking to pay a company for its sales We calculate receivable days using the following formula = 365 / (Sales / average of trade receivables outstanding at the start of the year and at the end of the year)

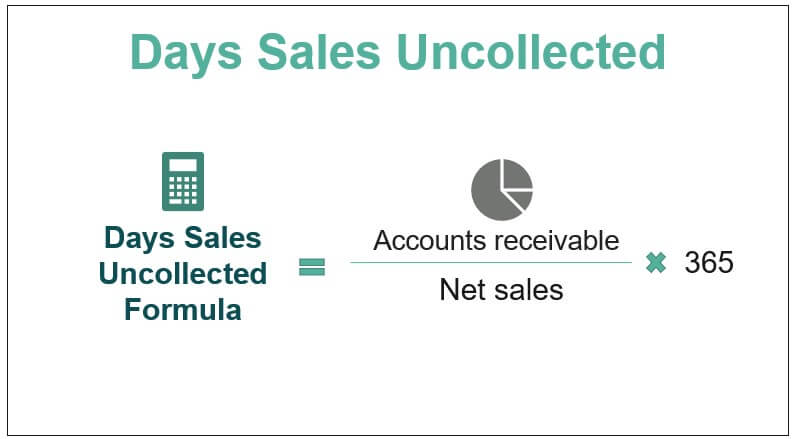

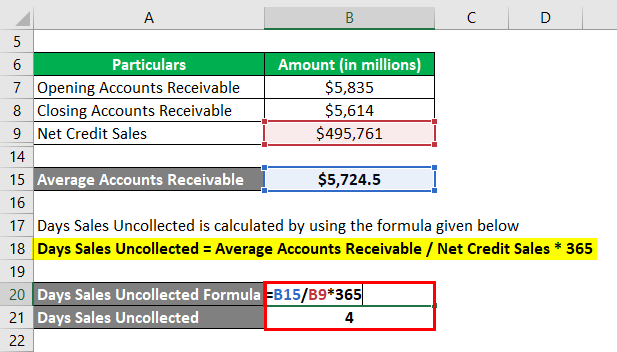

Days Sales Uncollected Different Examples With Limitations

Study Compute And Understand The Operating Cycle Intro To Accounting

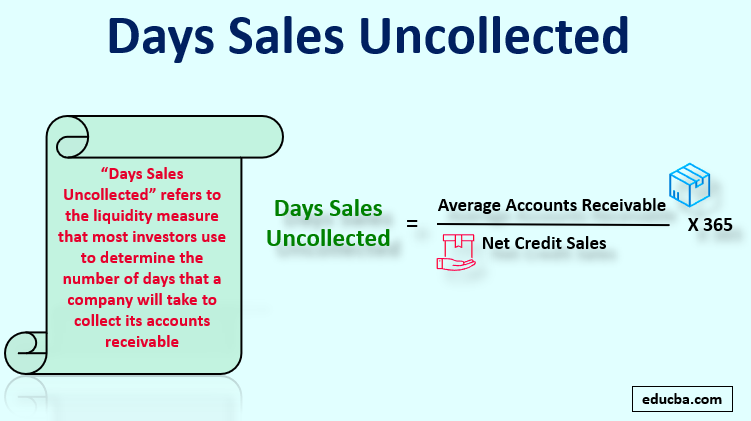

Days' sales uncollected is a liquidity ratio that is used to estimate the number of days before receivables will be collected This information is used by creditors and lenders to determine the shortterm liquidity of a company It can also be used by management to estimate the effectiveness of its credit and collection activitiesWhat are those used for? Accounts Receivable is the amount of money a company is due to receive This may be due to pending payments, sales on a credit basis, etcA company needs to monitor its Accounts Receivable as it is a source of cash inflow for the company Accounts Receivable is indicated as an asset in the balance sheet of the company and is expected to turn in cash over a year

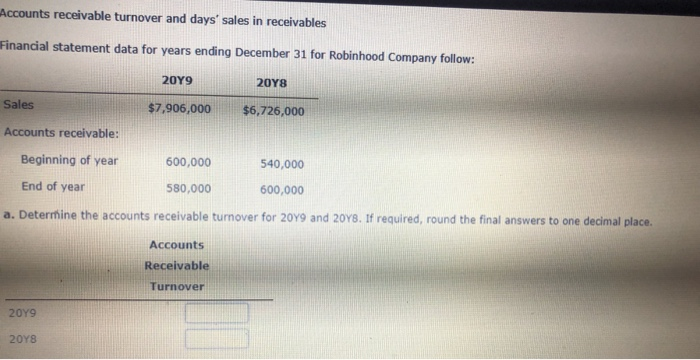

Accounts Receivable Turnover And Days Sales In Chegg Com

Days Sales Outstanding

The formula for Days Sales Outstanding is The numerator of this ratio is ending accounts receivable, taken from the balance sheet at the end of the period you're looking at For our example, let's assume it's $1,000 The denominator is revenue per day, take the annual sales figure divided by the number of days in a year, or 360 to use Days sales outstanding (DSO) is the measurement of the average number of days it takes a business to collect payments after a sale has been made In other words, it is the average length of time it takes a company to collect its accounts receivable (AR) The days' sales in accounts receivable can be calculated as follows the number of days in the year (use 360 or 365) divided by the accounts receivable turnover ratio during the past year For example, if a company's accounts receivable turnover ratio for the past year was 10, the days' sales in accounts receivable were 36 days (360 days

Days Sales Outstanding Template Download Free Excel Template

Receivables Turnover Vs Days Sales Outstanding Dso What S The Difference Gaviti

The formula for daily sales oustanding is DSO = Receivables / (Net Annual Sales on Credit / 360)Accounts Receivable Turnover (Days) (Year 2) = 325 ÷ (3854 ÷ 360) = 30,3 Accounts Receivable Turnover in year 1 was 28,5 days It means that the company was able to collect its receivables averagely in 28,5 days that year In year 2 this ratio increased, indicating that the company needed 30,3 days to collect its receivablesDays Receivables Outstanding measures the number of days it takes a company to collect cash generated from sales This is generally the average number of days between invoicing a customer and collecting payment

Accounts Receivable Turnover And Days Sales In Chegg Com

/calculate-cash-conversion-cycle-393115-v4-JS2-869f1dcda7b744abb1b815b2fd25c031.png)

Calculating The Cash Conversion Cycle Ccc

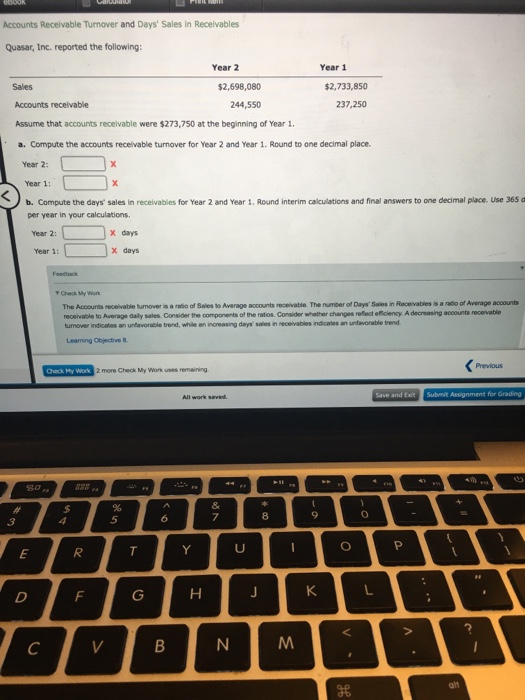

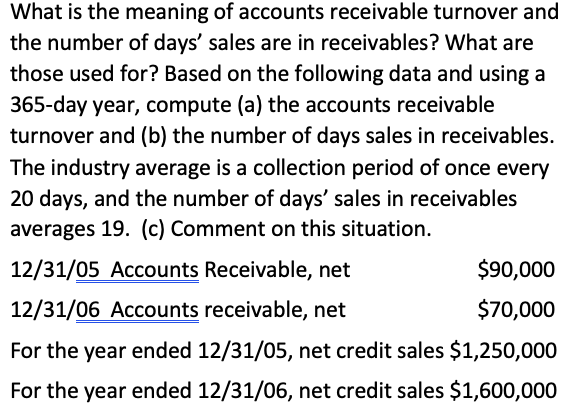

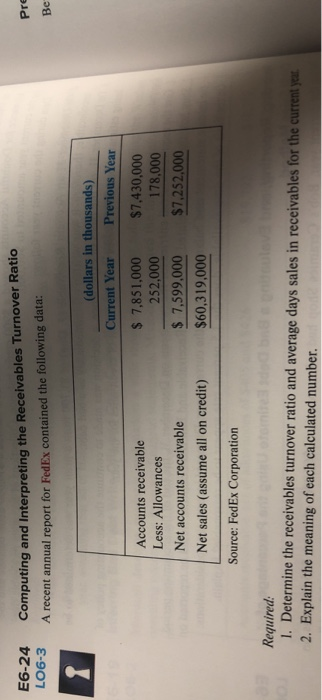

Day Sales Outstanding Day Sales Outstanding (DSO) is also known as the average collection period because it shows the average number of days it took accounts receivable to be collected Days Sales Outstanding (DSO) is the average number of days taken by a firm to collect payment from their customers after the completion of a sale As a business owner, you can also view DSO as the number of days it takes for credit sales to be converted to cash, or the number of days that receivables remain outstanding until they're collectedBased on the following data and using a 365day year, compute (a) the accounts receivable turnover and (b) the number of days sales in receivables The industry average is a collection period of once every days, and the number of days' sales in receivables averages 19

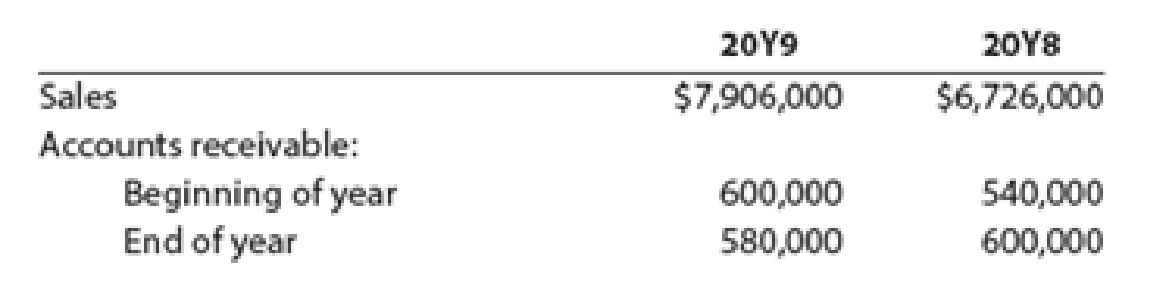

Accounts Receivable Turnover And Days Sales In Receivables For Two Recent Years Robinhood Company Reported The Following A Determine The Accounts Receivable Turnover For y9 And y8 Round Answers To One Decimal

Days Sales Outstanding Average Collection Period Youtube

The number of days' sales in receivables ratio is a usually a good indicator of manipulation activity A quicker collection period found in the first two years of operation can signal negative earnings behavior (as compared to industry standards) Earnings management can be a bit more difficult, given its acceptability under GAAP

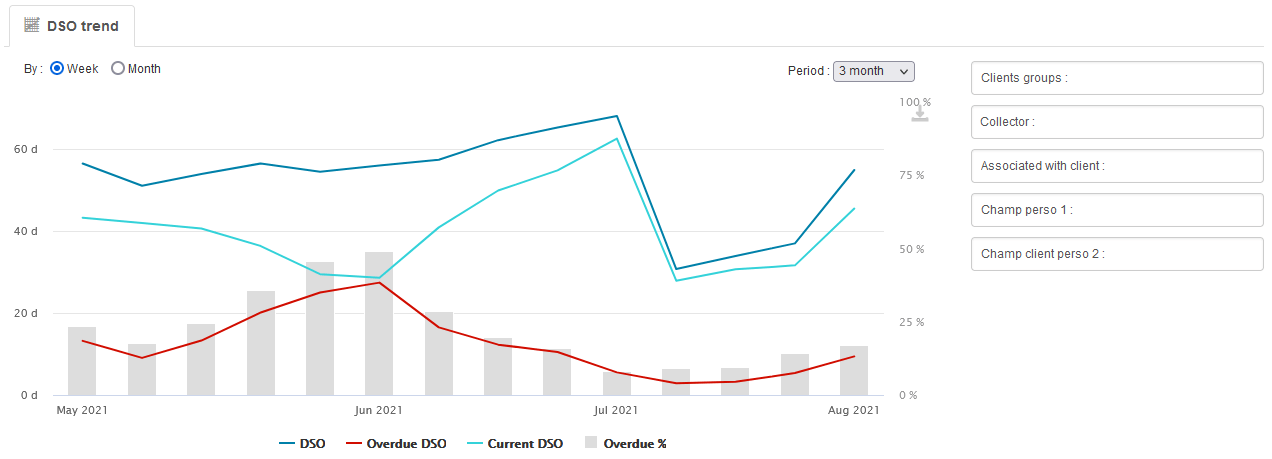

Dso Days Sales Outstanding Definition Calcul Difference Avec Dpo

Computing Days Sales In Receivables Youtube

Days Sales Outstanding Formula Meaning Example And Interpretation

Days Sales Outstanding Supply Chain Kpi Library Profit Co

Inventory Days Formula Meaning Example And Interpretation

Days Sales Outstanding Dso Ratio Formula Calculation

Days Sales In Receivables Is Determined By Dividing Chegg Com

Days Sales Outstanding Dso In Asset Utilization Ratios

Receivables Chapter 8 Chapter 8 Explains Receivables Ppt Download

/accounts-receivables-on-the-balance-sheet-357263-FINAL3-49402f58e70a42ab9468144f84f366d6.png)

Accounts Receivable On The Balance Sheet

How To Calculate Days Sales Outstanding Or Dso Calculation Paysimple

Nobles Fin5 Ppt 15

Days Sales Outstanding Formula Meaning Example And Interpretation

Debtor Receivable Days Tutor2u

Doc Wa00

How To Calculate Days Sales Outstanding Or Dso Calculation Paysimple

How To Improve Debtor S Receivable Turnover Ratio Collection Period

Days Sales Outstanding Define Formula Calculate Analysis Ideal Dso

Solved What Is The Meaning Of Accounts Receivable Turnove Chegg Com

Days Sales Outstanding Formula Meaning Example And Interpretation

Days Sales Outstanding Dso Definition

Day S Sales Uncollected Formula Step By Step Calculation Examples

/calculate-cash-conversion-cycle-393115-v4-JS2-869f1dcda7b744abb1b815b2fd25c031.png)

Calculating The Cash Conversion Cycle Ccc

What Is Days Sales Outstanding Dso Accountingcapital

Debtor Days Formula Calculator Excel Template

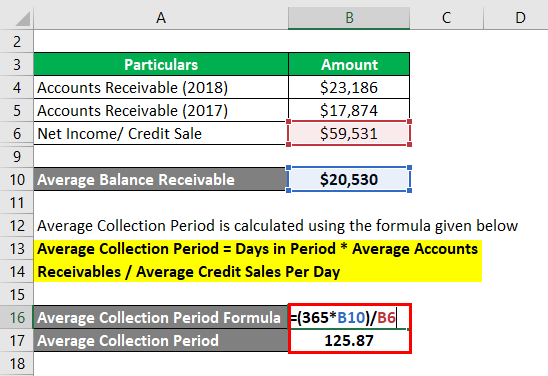

Average Collection Period Advantages Examples With Excel Template

F Xzppblgjkxnm

What Is The Dso Report

Debtor Days Meaning Formula Calculate Debtor Days Ratio

Solved E6 24 Computing And Interpreting The Receivables T Chegg Com

Day Sales Outstanding Formula Calculator Scalefactor

How To Calculate Dso On Accounts Receivables Billtrust

Measure And Manage Collection Efficiency Using Dso Abc Amega

Days Sales Outstanding Formula Meaning Example And Interpretation

Days Sales In Inventory Dsi Overview How To Calculate Importance

Days Sales Uncollected Different Examples With Limitations

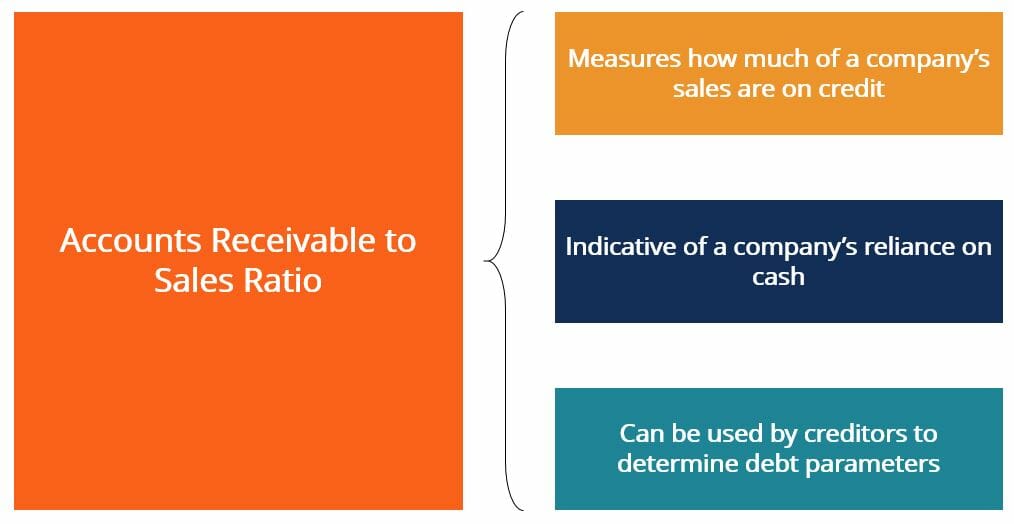

Accounts Receivable To Sales Ratio How To Calculate The Ratio

Dsri Days Sales In Receivables Index By Acronymsandslang Com

Account Receiveable Turnover Ratio What Is The Days Sales In Accounts Receivable Ratio The Days Sales In Accounts Receivable Ratio Also Known As The Course Hero

A Step By Step Guide To Calculating Days Sales Outstanding The Blueprint

3 Ways To Calculate Credit Sales Wikihow

Why Dso Should Be A Focus Kpi For Your Company Intellichief

Days Sales Outstanding Formula Meaning Example And Interpretation

What Is Dso And Why Is It The Lifeline For Accounts Receivable Versapay

/InvetoryturnoverfinalJPEGreal-5c8ff4fc46e0fb00014a975c.jpg)

Inventory Turnover Definition

Everything You Need To Know About Days Sales Outstanding

Days Sales Outstanding Meaning Formula Calculate Dso

Receivable Days A Complete Guide Dr Vijay Malik

Marty Zigman On Calculate Netsuite Days Sales Outstanding Dso With Saved Search

Everything You Need To Know About Days Sales Outstanding

What Does The Days Sales In Receivables Ratio Chegg Com

Accounts Receivable Turnover Analysis Definition The Strategic Cfo

Days Sales In Inventory Dsi Overview How To Calculate Importance

3kgaee6yj3mk0m

Nobles Fin5 Ppt 15

Chapter 8 Receivables Ppt Download

1

How To Calculate Days Sales Outstanding Or Dso Calculation Paysimple

Days Sales In Receivables Example Youtube

Days Sales Outstanding Formula Meaning Example And Interpretation

Accounts Receivable To Sales Ratio How To Calculate The Ratio

Accounts Receivable Turnover Ratio Meaning Formula

Average Collection Period Advantages Examples With Excel Template

Days Sales Uncollected Different Examples With Limitations

:max_bytes(150000):strip_icc()/dotdash_Final_How_should_investors_interpret_accounts_receivable_information_on_a_companys_balance_sheet_Apr_2020-01-93d387c085e04ab4bf99fa38dcdfd48d.jpg)

How Should Investors Interpret Accounts Receivable Information On A Company S Balance Sheet

What Is The Accounts Receivable Days Formula Gocardless

What Is The Dso Report

Days Sales Outstanding Dso Definition Formula Importance

1

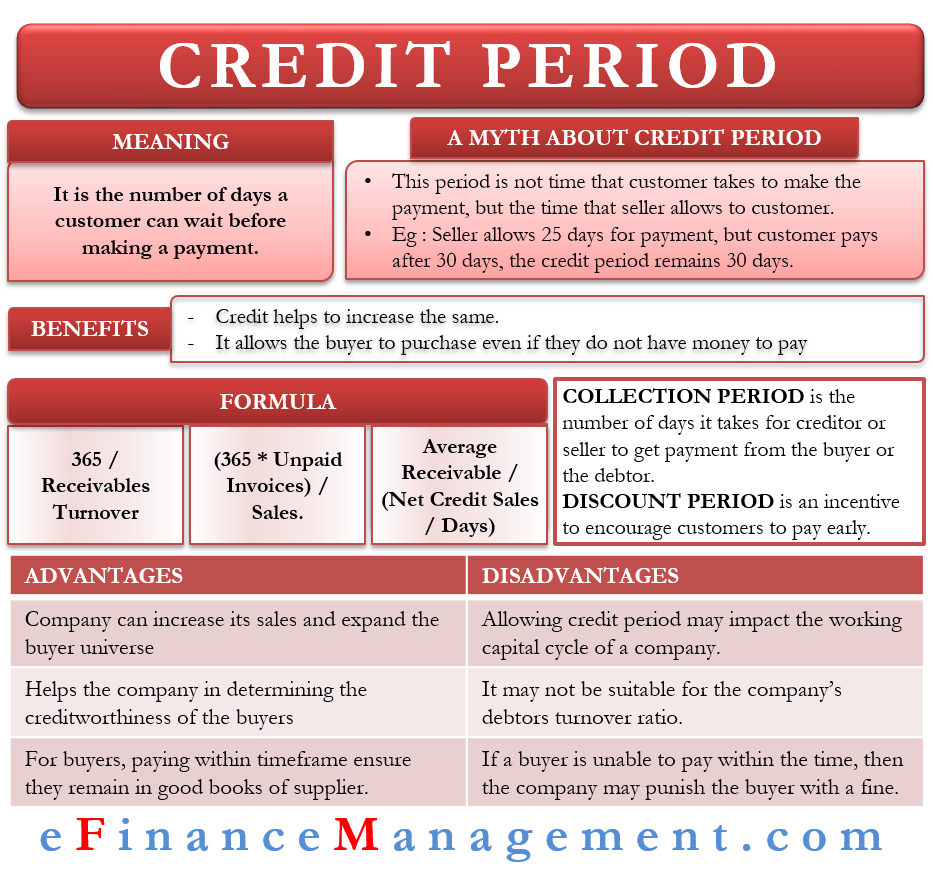

Credit Period Meaning Formula Advantages And More

A Look At The Cash Conversion Cycle

What Is Dso And How Do I Calculate It Measuring Days Sales Outstanding A How To Guide Invoicecare

Determine A The Accounts Receivable Turnover And B The Number Of Days Sales In Receivables Round Interim Calculations To The Nearest Dollar And Final Answers To One Decimal Place Assume A 365 Day

Days Sales Outstanding Formula Meaning Example And Interpretation

Days Sales Outstanding Formula Meaning Example And Interpretation

Days Sales

Accounts Receivable Turnover And Days Sales In Chegg Com

Days Sales Outstanding Dso Youtube

How To Calculate Days Sales Outstanding Dso Finance Friend

What S A Good Dso

A Step By Step Guide To Calculating Days Sales Outstanding The Blueprint

Days Sales Outstanding Dso Definition Calculation And Formula Zoho Books

0 件のコメント:

コメントを投稿